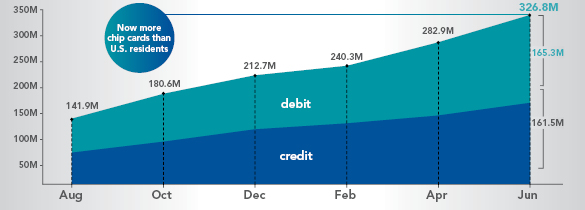

Millions of credit and debit card users have received at least one of the new “chip” cards, featuring a computer chip embedded right on the front. Even though the standard is relatively new in the U.S. (the last major economy to adopt it), we have already become the world’s largest chip market. As of June, Visa alone had issued more than 326 million chip cards - more than the number of U.S. residents!

In the U.S., the transition to chip cards is being driven by a shift in liability, rather than a government or industry requirement. Since Oct. 1, 2015 (a date set by MasterCard and Visa), if a chip card is used in a counterfeit transaction at a chip-enabled terminal, the card issuer bears responsibility for the fraud. This is the same process we have now, with existing magnetic stripe cards.

What has changed happens when a merchant does not have a chip card reader. Now, if a fraudulent transaction takes place, liability falls on the merchant, rather than the card issuer. The reasoning is, the issuer has invested in chip technology to make transactions more secure, while the merchant did not. Some exceptions are made in cases of card-not-present fraud, at fuel dispensers and through ATM transactions, which have more time to add chip card readers.

Although chip cards look similar to magnetic strip cards, the biggest change they bring is behavioral. Instead of swiping it, users insert, or “dip,” a chip card into a reader. Just as with magnetic stripe cards, shoppers may have to complete their purchases with either a signature or four-digit PIN (personal identification number) if the purchase is over a certain amount.

This process takes a few moments longer than with magnetic stripe cards because, each time a chip card is inserted, or “dipped,” into in chip-enabled terminal, it generates a unique, one-time use code for each transaction. Even if the data is stolen, it can’t be used to produce counterfeit cards. Magnetic stripe cards, on the other hand, store unchanging data which can be copied and reproduced.

Despite the promise of added security, some cardholders are still uncomfortable with this new technology:

- Some fear chip card data may be stolen remotely by criminals who digitally eavesdrop. This concern is most closely associated with so-called “tap-and-go,” or contactless cards, which send data wirelessly using Near Field Communication (NFC) technology. But most chip cards, including those issued by Delta Community, are not NFC enabled, so they are not susceptible to this type of fraud.

- Merchants who insist on PINs (personal identification numbers) for chip debit card transactions frustrate some cardholders. Most chip debit cards, including those issued by Delta Community, are designed to work with PINs or signatures and merchants who force cardholders to use PINs may be in violation of their agreement with card issuers. Visa even provides a way to report such problems with in-store purchases.

- While chip cards are said to be more secure for in-person purchases, they are not necessarily more secure than traditional cards when used online or over the phone. Services such as Visa Checkout and Verified by Visa offer additional security for online shoppers. Many financial institutions, including Delta Community, also offer protection with Visa’s Zero Liability policy against fraudulent activity.*

- Globally, nearly 37 million chip card terminals are available in more than 130 countries, so travelers can conveniently use chip cards worldwide. Thanks to enhancements in Visa’s acceptance rules, the approval rate for Visa chip transactions overseas is more than 96 percent. However, card readers outside the U.S. are more likely to be configured for chip-and-PIN transactions. Before traveling internationally, cardholders should check with their issuer for information about using their cards as chip-and-PINs.

- Another frustration is stores’ uneven availability of working chip card terminals. Updating millions of payment terminals nationwide is a complicated and costly undertaking, and full implementation of chip card technology may take years. The good news is, tens of thousands of merchants add chip terminals every week. And most new chip cards are also still equipped with magnetic stripes, so they can still be used with traditional terminals when necessary.

By paying close attention to communications from their card issuers, following up with questions and practicing patience, consumers can help smooth this conversion. It is a complex change, not only in hardware but also in behavior – and was never expected to happen overnight. But the promise of greater security for financial and personal information makes this technology well worth the wait.

*Visa’s Zero Liability Policy covers U.S.-issued cards and does not apply to certain commercial card transactions, or any transactions not processed by Visa.