This year's COVID-19 coronavirus pandemic has disrupted millions of lives as Americans have either lost their jobs permanently or been furloughed with less work and lower wages. This disruption forced former employees to carefully consider their long-term employment options and start making what may be difficult decisions as to how they can move forward with their careers or transition to early retirement.

Some of the first decisions those who are newly unemployed need to consider is whether or not they should enter their retirement years earlier than originally planned. This decision is especially relevant if a worker believes that they may not be able to find employment due to their age, or, if the job market has declined substantially as a result of the economic climate.

If you (or someone you know) are considering retirement, there are a number of actions you need to take as you progress on that path. We've provided a checklist of some retirement transition steps that are below both to read and to download.

Develop a Retirement Income Strategy. Replacing your paycheck in retirement will require careful planning. With fewer pension plans offered to today's retirees, careful management of 401(k) resources is vital to a successful transition.

Inquire About Your Health Insurance. Be clear when your employer-sponsored coverage ends. If you or your spouse have reached age 65, review your Medicare options. If either of you are under age 65, consider extending your employer coverage with COBRA or compare plans at the Health Insurance Marketplace.

Understand Social Security Planning. When to begin Social Security is one of the most important decisions a retiree will make. Special consideration and strategies are needed for married couples.

Know Your Monthly Budget. Consider grouping living expenses into “essential” and “discretionary”. Without employment income, budgeting mistakes are more challenging to correct in retirement. Plan for the long term. How long can your financial resources last to maintain your monthly living expenses? Be careful not to underestimate expenses and be sure to build inflation into any future forecast.

Consolidate and Simplify Accounts. Rolling over old 401(k) accounts into one IRA can simplify your Required Minimum Distributions which now begin at age 72 for new retirees. Take the time to educate yourself on your options.

Write or Update Your Estate Plan. Beginning this new chapter in your life is a great time to ensure you maintain control of your assets during life and at death.

Have a Written Plan for Long-term Care. Most retirees will need some form of long-term care assistance. The time to plan is before you need it. A good long-term plan answers three essential questions. Who will be involved? Where will it take place? How will it be funded?

Consider Your Housing Options. A two-story home might be ideal for raising a family, but maybe not for retirement. If you're thinking of moving to a new area, consider renting before buying.

Have a Sense of Purpose. You're retiring from work, not from life. Keeping active in retirement has shown to add joy and enhance longevity. Stay connected with family and friends. Commit to causes you love.

Take Care of Yourself. Feed your mind and body with goodness. Eat fresh foods. Get plenty of sleep. You can't stop the hands of time but you can rewind the clock.

Consider working with a CERTIFIED FINANCIAL PLANNERTM professional (CFP®). Our CERTIFIED FINANCIAL PLANNER™ professionals are committed to providing members of Delta Community actionable guidance and advice so they can make informed decisions. You can rest easy knowing you have an ally that is held to the highest fiduciary standard and is trained to help navigate your financial life, no matter how ambitious or complex. Call us today at 404-677-4890 to learn more.

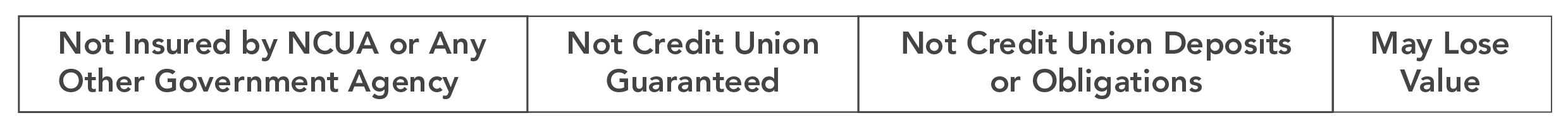

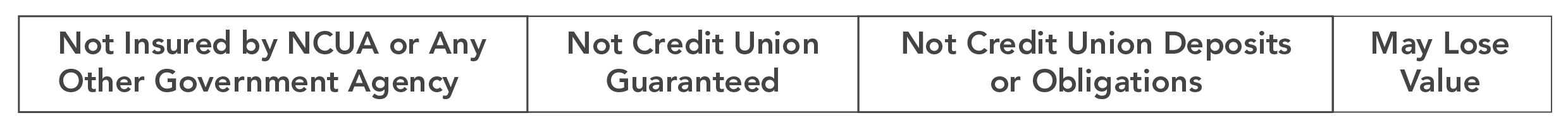

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker/dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Delta Community Credit Union and Delta Community Retirement & Investment Services are not registered as a broker/dealer or investment advisor. Registered representatives of LPL offer products and services using Delta Community Retirement & Investment Services, and may also be employees of Delta Community Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from and not affiliates of Delta Community Credit Union or Delta Community Retirement & Investment Services. The Delta Community Retirement & Investment Services site is designed for U.S. residents only. The services offered within this site are offered exclusively through our U.S. registered representatives. LPL Financial Registered Representatives associated with this site are licensed in all 50 states. Securities and insurance offered through LPL or its affiliates are: