September is back to school season in most areas and with the new academic year comes a renewed focus on teaching, learning and preparing children (of all ages) for adulthood. In addition to the traditional subjects of reading, writing and arithmetic, now is a great time for parents to commit to providing financial education to school-age children.

In an age of ATMs and online and mobile banking, the difficulty with teaching children about money is that so few of us still use, well,

money: the tangible coins and bills that give kids something to see, feel and count.

“Virtual currency, which allows us to make transactions with credit cards, or on our computers or cellphones, is really convenient and may even be more secure than physical money,” said Reina Short, who facilitates classes for Delta Community Credit Union’s

Financial Education Center. “But it may also make it difficult for children to grasp the value of cash, since they never see it changing hands.”

The good news is that children today are digital natives, capable of completing tasks online, on phones and just about anywhere in the digital space. But parents must still fill the important role of providing them with guidelines for handling money.

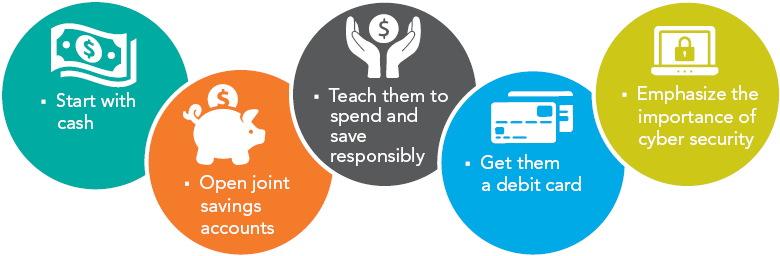

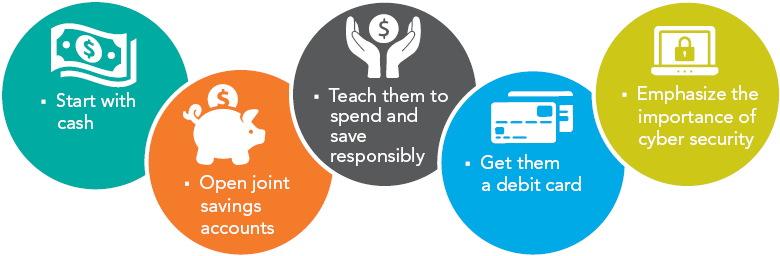

For young children, it’s still a good idea to start with cash. Let them save coins in a piggy bank or glass jar so they can see their funds add up. Parents who have gotten out of the habit should make a point to carry cash and spend it in front of their kids to illustrate that money can help us acquire things we need and want.

Children old enough to save a little money and understand math are old enough to have bank accounts. Open joint

savings accounts with children to help them understand they can own a specific amount of money without having it physically in their hands.

As digital natives, children today are well equipped to go online and check their account balances. Once children learn how to log in to online banking, parents could even set up automatic transfers to deposit allowances directly into their accounts.

It may be easy for children to quickly grasp the mechanics of saving and spending “virtual” money, but it is even more important for parents to talk about their own unique financial philosophy. “Swiping a debit or credit card is fast and convenient, but children need to understand there is real money coming out of their accounts,” said Short. “It is vital to communicate the importance of saving wisely, spending within your means and donating to charitable causes that are important to you and your family.”

To illustrate how online or credit card purchases affect savings, parents can let children join them online to purchase items, make charitable donations or pay household bills. When kids see the same amount subtracted from their parents’ account (or added to a credit card balance) they may better understand how money is being moved around – even if they can’t actually see the physical money.

When children are independent enough to need spending money, parents may want to get them a debit card. Parents should load the card with a specific amount and register for online and mobile banking to track how the balance changes based on spending.

Any financial education must include serious conversations about safety. Past generations were taught to keep a tight hold on their purses or a close eye on their wallets. Today, parents must also teach children the importance of cyber security. Emphasize the need to use a secure password for mobile and online accounts, and conduct financial transactions only on trusted networks.

Finally, parents should monitor children’s online and mobile banking on a consistent basis. Staying involved will not only protect children’s online safety, it will also keep the lines of communication – and opportunities for financial education – open.